Npv calculator with steps

Calculate Net Present Value. This calculation sums up the total of all adjusted cash flows accounting for inflow and.

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Net Present Value Npv What It Means And Steps To Calculate It

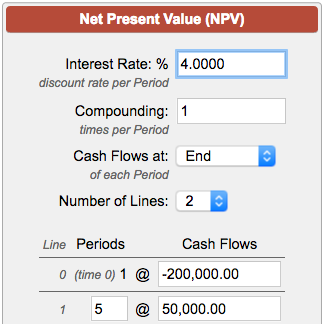

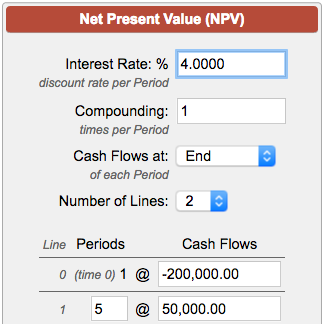

Calculate the Net Present Value NPV of an investment.

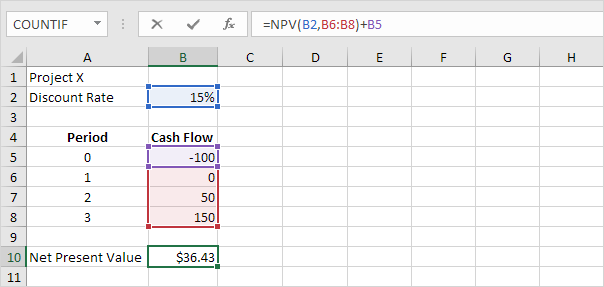

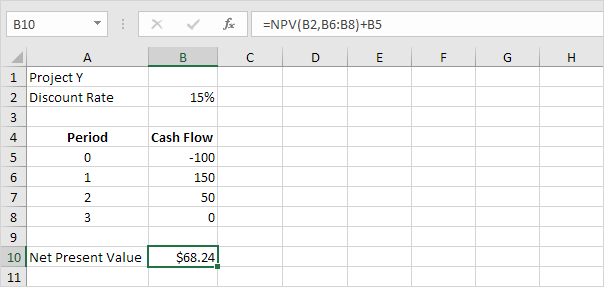

. The internal rate of return is the discount rate that makes the net present value equal to zero. You can also add or delete period. In Excel there is a NPV function that can be used to easily calculate net present value of a series of cash flow.

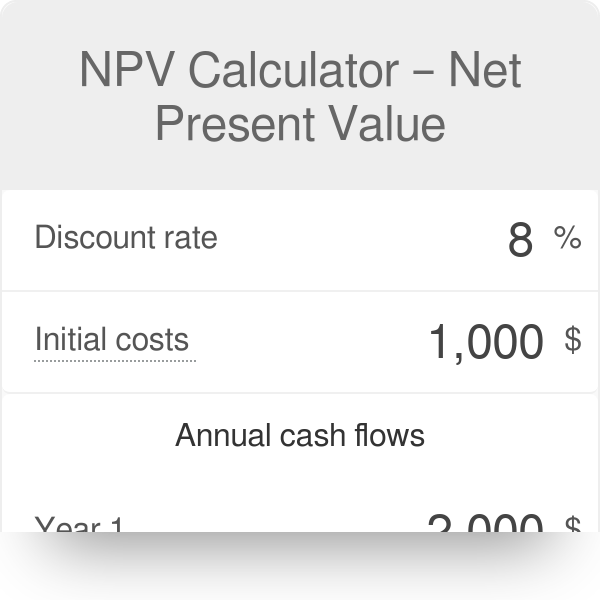

The NPV function simply. To calculate NPV or Net Present Value enter the initial investment the expected discount rate and cash flows for each period. Its an online NPV calculator.

1 The NPV function in Excel is simply NPV and the full formula. More specifically you can calculate the present value of uneven cash flows or even cash flows. Our calculator can handle any.

NPV 722169 - 250000 or 472169. Npv calculator with steps - how to calculate npv net present value in excel. Net present value -cost of initial investment cash flow of the first year 1 discount rate cash flow of the second year 1 discount rate² cash flow of the third.

In order to calculate the present value of one future cash flow this is the present value formula. For example if your discount rate is in cell A2 the investment amount is in A3 and the return value is in A4 your formula would read NPV A2A3A4. Open the document in which you want to calculate npv.

How to Use The NPV Calculator in Excel Download the NPV calculator using the form above. Net Present Value - NPV. Next perform the full calculation with the initial investment.

Start by entering the initial investment and the period of the. Calculate present value step by step. What I want to Find.

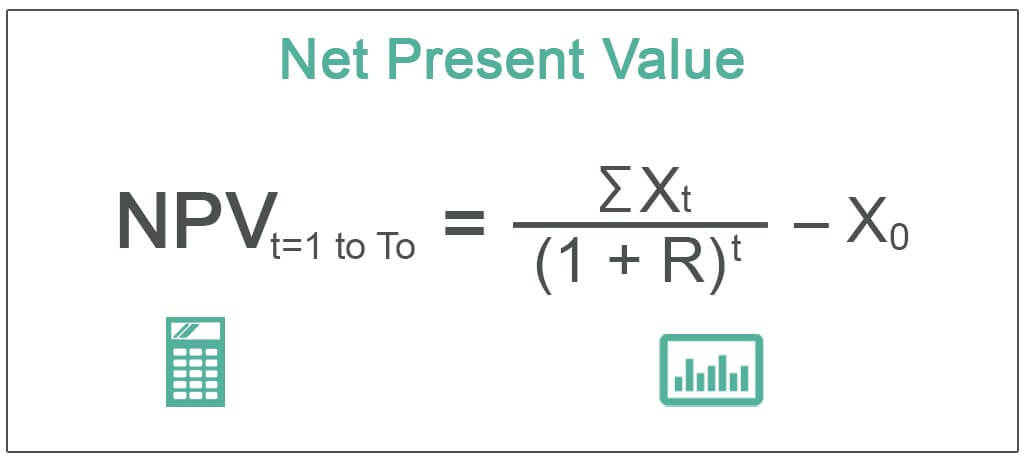

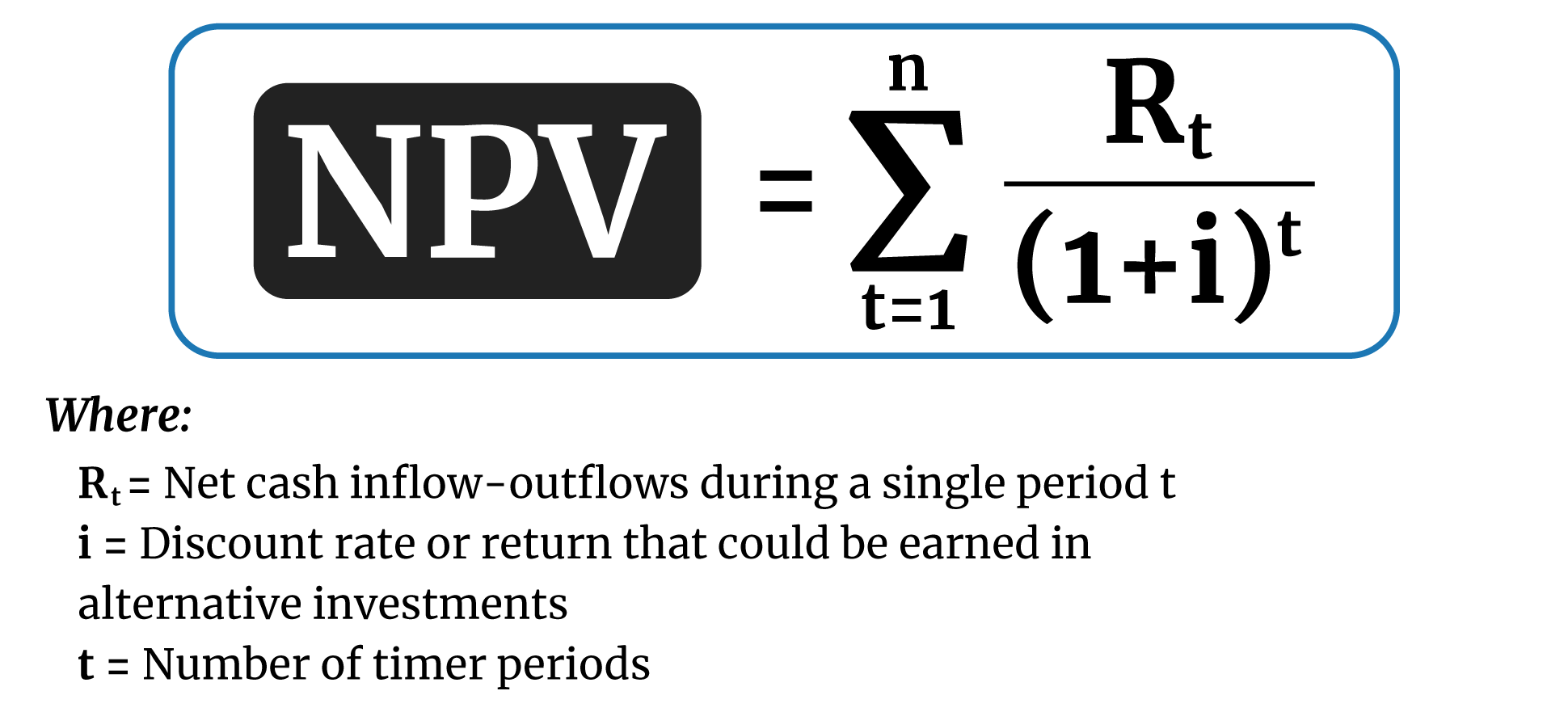

Then to compute the final NPV subtract the initial outlay from the value obtained by the NPV function. Visit our page about the IRR function to learn more about this topic. Net Present Value NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

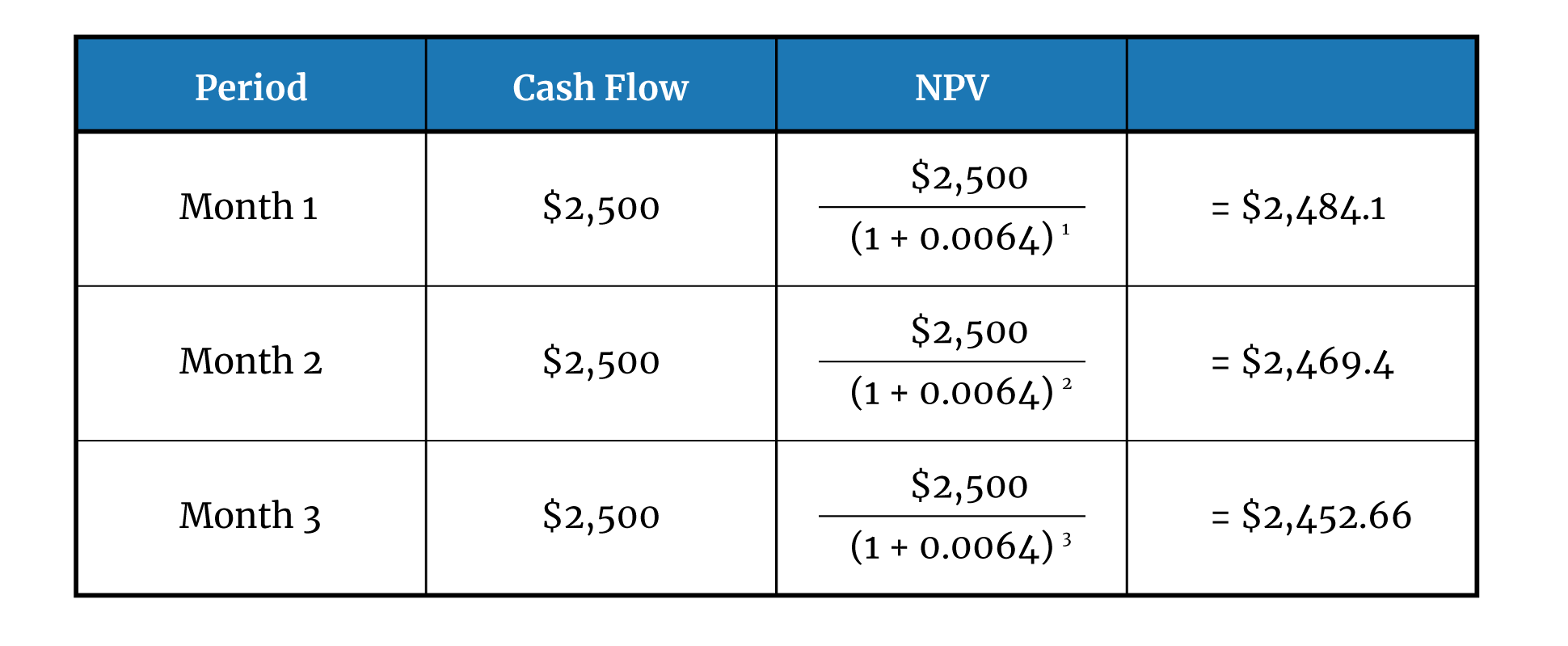

In order to calculate NPV we must discount each future cash flow in order to get the present value of each cash flow and then we sum those present values associated with each time. We will also learn some basic t. Please pick an option first.

Adjust the number of periods you want in your holding period. Calculate the net present value NPV of a series of future cash flows. After calculating the present value then repeat this for all of your future net cash flows and.

This computed value matches. Hp 10bii financial calculator npv calculation. The NPV calculator considers the expenses revenue and capital costs to determine the worth of an investment or project.

Calculate gross return Internal Rate of Return IRR and net cash flow. In this video we will learn how to perform basic Net Present Value NPV calculations on a Sharp EL-738 financial calculator. It helps in determining if it is worth pursuing an investment.

Net Present Value Calculator With Example Steps

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Npv Calculator Propertymetrics

Net Present Value Npv Formula And Calculator Excel Template

Net Present Value Calculator

Npv Calculator Net Present Value

What Is The Net Present Value Npv How Is It Calculated Project Management Info

Npv Formula In Excel In Easy Steps

Net Present Value Npv Formula And Calculator Excel Template

Net Present Value Npv Meaning Formula Calculations

Net Present Value Calculator

Net Present Value Calculator With Example Steps

Npv Formula In Excel In Easy Steps

Net Present Value Npv Calculation Steps Milestonetask

Formula For Calculating Net Present Value Npv In Excel

Formula For Calculating Net Present Value Npv In Excel

Calculate Npv In Excel Net Present Value Formula